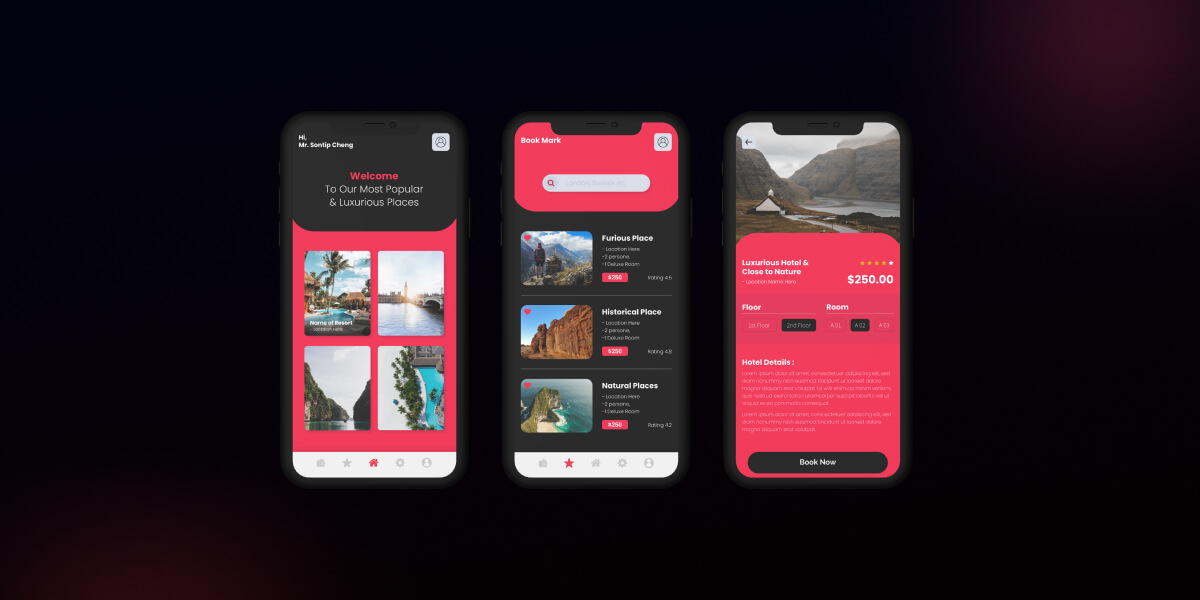

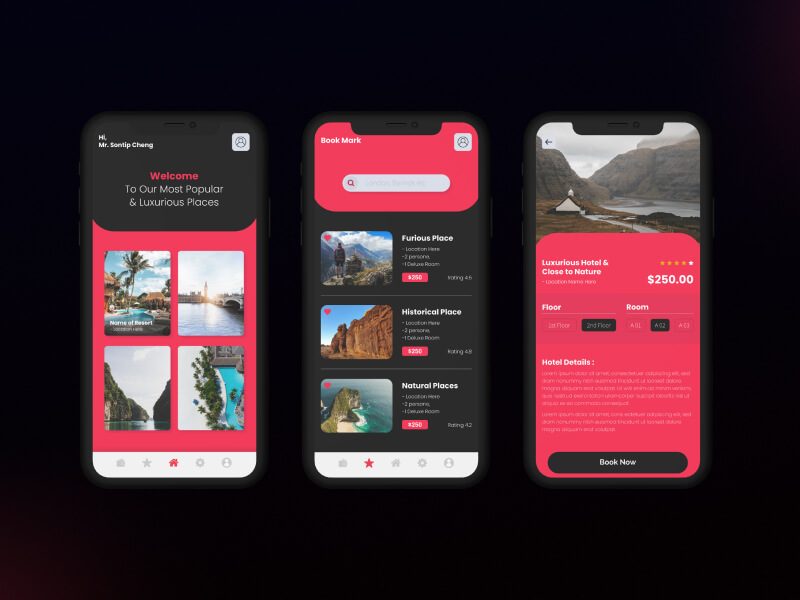

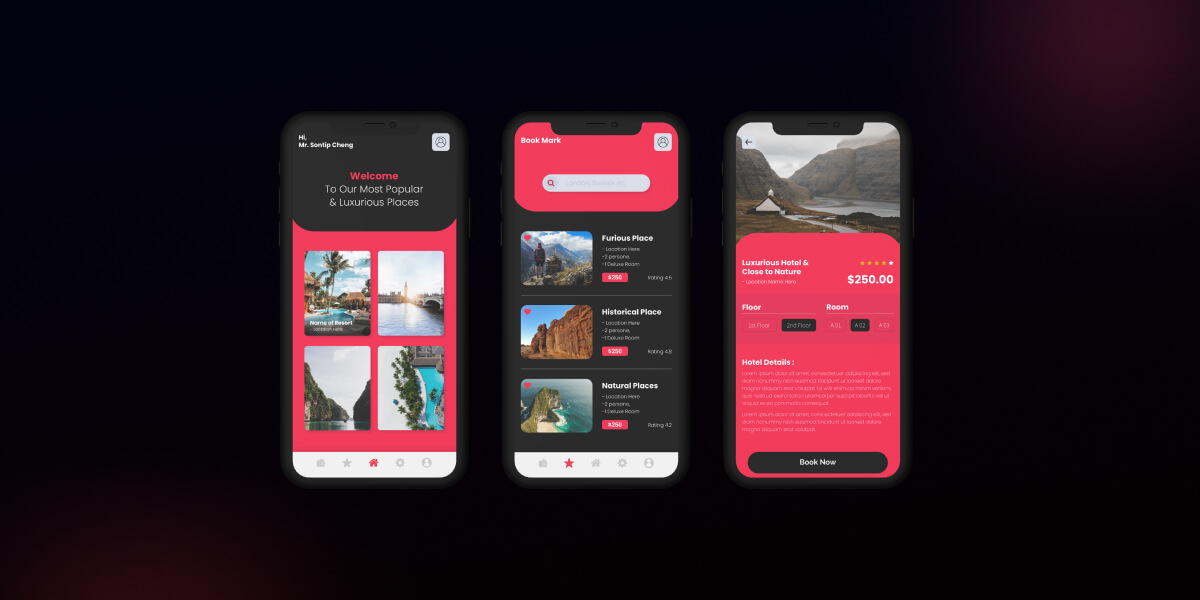

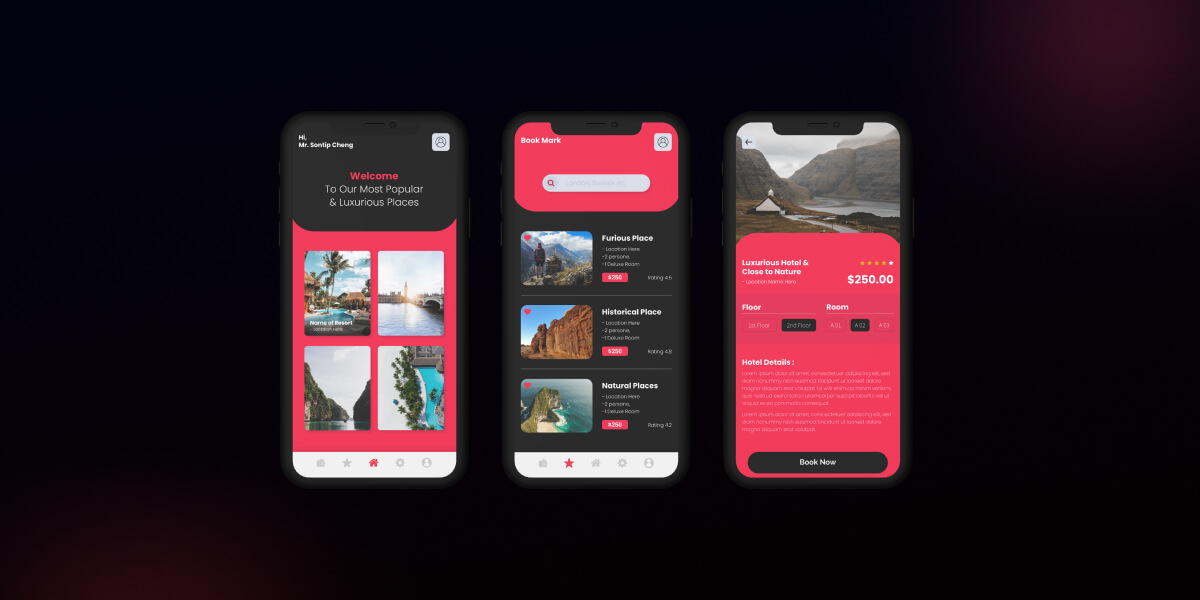

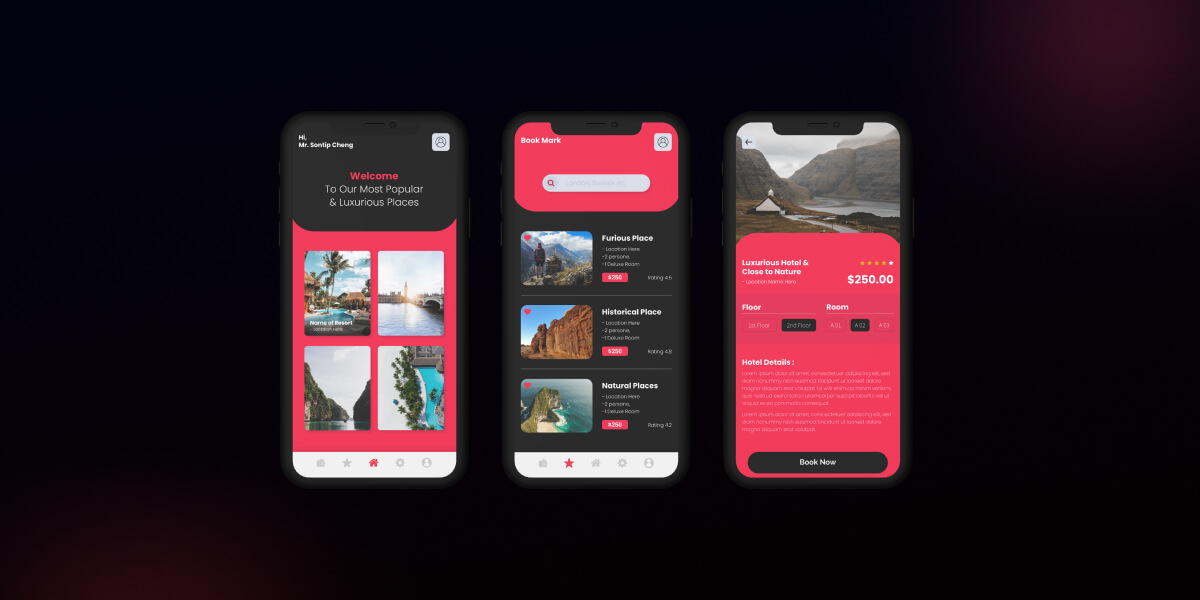

NFT Dashboard Application Development.

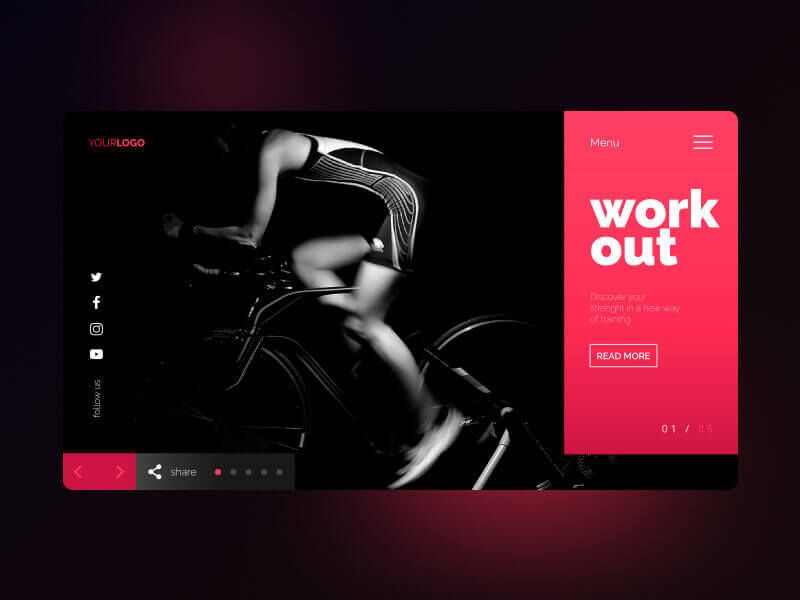

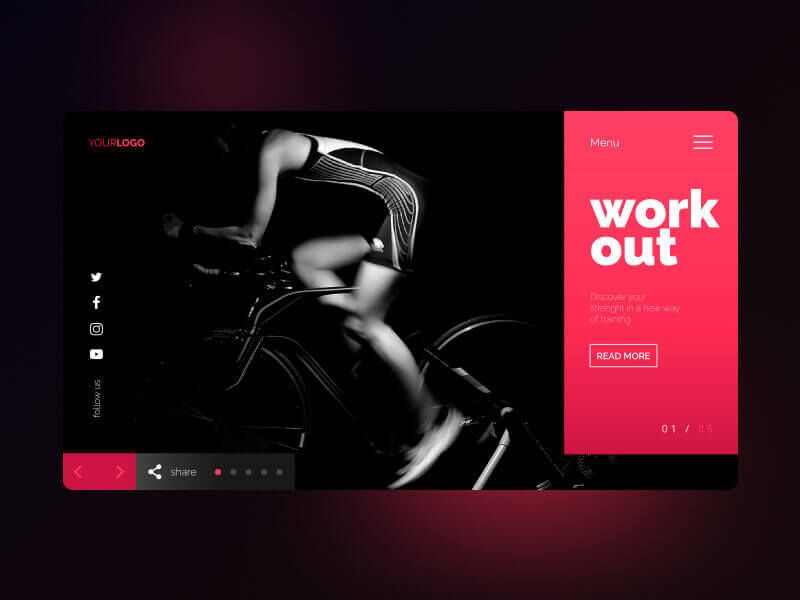

Through a wide variety of mobile applications, we’ve developed a unique visual system.

- Client George Wallace

- Date 15 June 2022

- Services Web Application

- Budget $100000+

I throw myself down among the tall grass by the stream as Ilie close to the earth.

I throw myself down among the tall grass by the stream as Ilie close to the earth.

I throw myself down among the tall grass by the stream as Ilie close to the earth.

Through a wide variety of mobile applications, we’ve developed a unique visual system.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

A strategy is a general plan to achieve one or more long-term. labore et dolore magna aliqua.

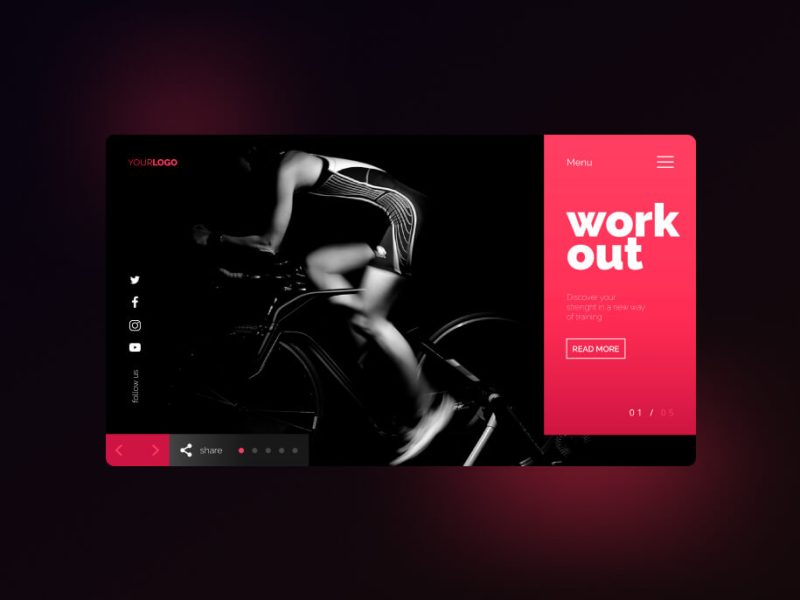

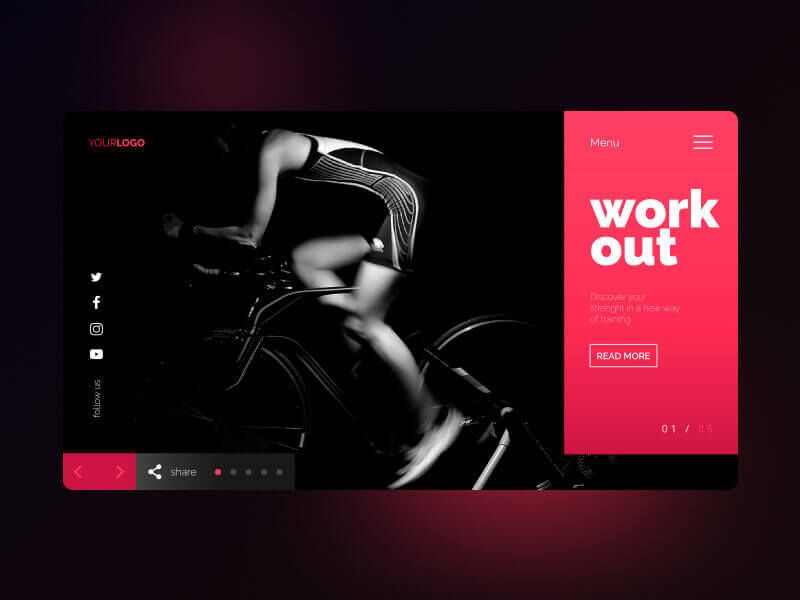

UI/UX Design, Art Direction, A design is a plan or specification for art. which illusively scale lofty heights.

User experience (UX) design is the process design teams use to create products that provide.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications.

UI/UX Design, Art Direction, A design is a plan or specification for art viverra maecenas accumsan.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

The B.Com. program at Swami Ramanand Teerth Marathwada University is well-known for its rigorous curriculum, experienced faculty, and emphasis on practical learning. The program is designed to provide students with a comprehensive understanding of business, accounting, finance, economics, and management principles.

Bharati Vidyapeeth is known for its excellent law program, and by completing your degree there, I have gained a deep understanding of legal theory and practice. I had coursework that has prepared me to tackle complex legal issues, communicate effectively, and provide strategic legal advice.

Studying at the University of Sussex has been an incredible experience. The LL.M. program in International and European Trade Law is well-known for its focus on practical learning, innovative teaching methods, and outstanding faculty. The program has equipped me with a deep understanding of the legal frameworks and principles governing international trade and commerce, and has honed my research, analytical, and writing skills.

As a Product Manager, my responsibilities include overseeing the development and implementation of new products and services, conducting market research, analyzing data, and working closely with cross-functional teams to ensure the success of our products. Modulr is a leading fintech company that specializes in payment solutions, and I am proud to be a part of such an innovative organization.

Working at Credit Suisse has been an enriching experience for me, as it provided me with exposure to the dynamic and ever-changing world of financial services. I had the opportunity to work with a diverse group of professionals, including subject matter experts, business analysts, and developers, who provided me with invaluable insights into their respective domains.

The India economy has grown strongly over recent years, having transformed itself from a producer and innovation-based economy.

The B.Com. program at Swami Ramanand Teerth Marathwada University is well-known for its rigorous curriculum, experienced faculty, and emphasis on practical learning. The program is designed to provide students with a comprehensive understanding of business, accounting, finance, economics, and management principles.

Bharati Vidyapeeth is known for its excellent law program, and by completing your degree there, I have gained a deep understanding of legal theory and practice. I had coursework that has prepared me to tackle complex legal issues, communicate effectively, and provide strategic legal advice.

Studying at the University of Sussex has been an incredible experience. The LL.M. program in International and European Trade Law is well-known for its focus on practical learning, innovative teaching methods, and outstanding faculty. The program has equipped me with a deep understanding of the legal frameworks and principles governing international trade and commerce, and has honed my research, analytical, and writing skills.

As a Product Manager, my responsibilities include overseeing the development and implementation of new products and services, conducting market research, analyzing data, and working closely with cross-functional teams to ensure the success of our products. Modulr is a leading fintech company that specializes in payment solutions, and I am proud to be a part of such an innovative organization.

Working at Credit Suisse has been an enriching experience for me, as it provided me with exposure to the dynamic and ever-changing world of financial services. I had the opportunity to work with a diverse group of professionals, including subject matter experts, business analysts, and developers, who provided me with invaluable insights into their respective domains.

The India economy has grown strongly over recent years, having transformed itself from a producer and innovation-based economy.

The B.Com. program at Swami Ramanand Teerth Marathwada University is well-known for its rigorous curriculum, experienced faculty, and emphasis on practical learning. The program is designed to provide students with a comprehensive understanding of business, accounting, finance, economics, and management principles.

Bharati Vidyapeeth is known for its excellent law program, and by completing your degree there, I have gained a deep understanding of legal theory and practice. I had coursework that has prepared me to tackle complex legal issues, communicate effectively, and provide strategic legal advice.

Studying at the University of Sussex has been an incredible experience. The LL.M. program in International and European Trade Law is well-known for its focus on practical learning, innovative teaching methods, and outstanding faculty. The program has equipped me with a deep understanding of the legal frameworks and principles governing international trade and commerce, and has honed my research, analytical, and writing skills.

As a Product Manager, my responsibilities include overseeing the development and implementation of new products and services, conducting market research, analyzing data, and working closely with cross-functional teams to ensure the success of our products. Modulr is a leading fintech company that specializes in payment solutions, and I am proud to be a part of such an innovative organization.

Working at Credit Suisse has been an enriching experience for me, as it provided me with exposure to the dynamic and ever-changing world of financial services. I had the opportunity to work with a diverse group of professionals, including subject matter experts, business analysts, and developers, who provided me with invaluable insights into their respective domains.

The India economy has grown strongly over recent years, having transformed itself from a producer and innovation-based economy.

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris test

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

1 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

2 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

8 Plugins/Extensions

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

5 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

5 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

50 Plugins/Extensions

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

10 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

20 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

100 Plugins/Extensions

As a product manager, navigating product development challenges is a part and parcel of the job. Every product development project comes with its own set of unique challenges, and it’s important to be able to identify and overcome them to ensure that the product is delivered on time, within budget, and with the desired features and functionality.

Navigating product development issues is part of the job of a product manager. Every product development project presents its own set of unique obstacles, and it is critical to be able to identify and overcome them in order to ensure that the product is delivered on time, under budget, and with the desired features and functionality. Here are some of the insights and experiences I’ve gathered through managing product development challenges: Managing conflicting priorities: One of the most difficult issues in product development is balancing opposing priorities. This can be caused by competing stakeholder expectations, insufficient resources, or shifting market demands. To manage competing priorities, it’s critical to grasp the product’s vision, goals, and objectives. This will assist in making educated decisions concerning

One of the most common challenges in product development is managing competing priorities. As a Product Manager, you must balance the needs of your customers, your company, and your team. To overcome this challenge, it’s essential to establish clear goals and priorities for your product. This will help you make informed decisions about what features to prioritize and what trade-offs to make.

Another challenge in product development is dealing with unexpected roadblocks. These can come in many forms, such as technical issues, resource constraints, or market changes. To overcome these roadblocks, it’s important to be flexible and adaptable. This means being willing to pivot your strategy or adjust your timelines as needed. It’s also important to maintain open communication with your team, stakeholders, and customers to identify potential roadblocks early on and address them proactively.

Prioritizing features is another common challenge in product development. It can be tempting to try to include all possible features to make your product more attractive to customers. However, this can lead to a bloated, unfocused product that is difficult to use and maintain. To overcome this challenge, it’s important to stay focused on the core value proposition of your product and prioritize features that align with that proposition. It’s also important to involve your team and customers in the prioritization process to ensure that you’re building the right features at the right time.

In conclusion, navigating product development challenges requires a combination of strategic thinking, adaptability, and effective communication. By establishing clear goals and priorities, being flexible and adaptable, and prioritizing features that align with your core value proposition, you can overcome common challenges and build successful products. Remember that challenges are a natural part of the product development process, and by embracing them, you can learn, grow, and ultimately succeed.

djtzsfrw

In today’s rapidly evolving business landscape, it is essential for professionals in the field of business analysis to stay up-to-date with emerging trends and technologies. These new developments have the potential to transform the way we approach business analysis, and can help us to work more efficiently and effectively. Business analysis is a critical function in any organization, and it involves the identification, analysis, and documentation of business needs and requirements. As technology continues to evolve, the role of the business analyst is also evolving, and it’s essential to stay up-to-date with emerging trends and technologies in this field. In this blog, we will discuss some of the latest trends and technologies in the field of business analysis.

As a business analyst, it is essential to keep up with these emerging trends and technologies. To stay ahead of the curve, professionals in this field should invest in ongoing training and education to develop their skills in areas such as data analytics, AI and ML, and emerging technologies. By doing so, they can position themselves as valuable contributors to their organizations and take advantage of the exciting opportunities that these trends and technologies are creating.

In conclusion, the field of business analysis is undergoing significant changes due to emerging trends and technologies. These developments are opening up new opportunities for professionals in this field to add value to their organizations and drive business success. By staying informed and investing in ongoing education and training, business analysts can position themselves as leaders in this dynamic and exciting field.

Collaboration and communication are critical components of requirements engineering. It involves working with stakeholders, such as product owners, developers, and testers, to ensure that everyone is aligned and working towards the same goal. Effective communication helps to build trust and foster a culture of openness and transparency, which ultimately leads to better results.

As a Requirements Engineer at Credit Suisse, I have had the opportunity to work on numerous projects, collaborating with cross-functional teams to deliver high-quality products. Through my experience, I have come to understand the importance of collaboration and communication in the requirements engineering process.

Effective communication is another critical aspect of requirements engineering. Clear communication ensures that everyone is on the same page and understands the project’s objectives, timelines, and requirements. Miscommunication can lead to delays, cost overruns, and ultimately, project failure. Therefore, it is crucial to establish open and transparent communication channels between team members.Visit our partners,shoes – leaders in fashionable footwear!

Prioritizing features is another critical aspect of requirements engineering. It’s important to work closely with stakeholders to determine which features are essential for the success of the project and to prioritize these accordingly. This involves not only understanding business goals but also taking into account technical constraints and feasibility.

In addition to managing priorities, dealing with unexpected roadblocks is another challenge that requires effective collaboration and communication. By maintaining open lines of communication and working collaboratively to find solutions, the team can overcome obstacles and keep the project moving forward.

At Credit Suisse, we utilized various tools and techniques to facilitate collaboration and communication in requirements engineering. We held regular meetings, such as daily stand-ups, to discuss project progress and identify any roadblocks. We also used collaboration software, such as JIRA, to manage project tasks, track progress, and communicate with team members.

In conclusion, collaboration and communication are essential to successful requirements engineering. Working closely with stakeholders and maintaining open lines of communication helps to manage competing priorities, deal with unexpected roadblocks, and prioritize features effectively. My experience as a Requirements Engineer at Credit Suisse taught me the importance of collaboration and communication in software development and how it can lead to better results.

I am available for freelance work. Connect with me via and call in to my account.

Phone: +01234567890 Email: admin@example.com